ETFs - NIFTYBEES JUNIORBEES - SIMPLE & FABULOUS

Authored On: 23-Jun-15

Last Modified: 23-Jun-15

About. . .

Article details about excellent ETFs NSE:NIFTYBEES and NSE:JUNIORBEES. ETFs provide excellent investing tool for investors where they can match the performance of benchmark at very low cost. All investors must have these two excellent ETFs, article emphasises.

-

ETFs are exchange traded mutual funds

-

As the name suggests, unlike normal mutual fund schemes, investors will have to buy and sell units of ETFs on exchanges just like they do with stocks and other tradable instruments.

-

The way mutual fund schemes will have underlyings as equity or say bonds or mix of these or other instruments as their investments, ETFs too carry an 'underlying', which could be say commodity such as say gold, or a basket of specific stocks - say banking stocks or it could be index, in which case the basket of stocks are those which are in index and proportions in basket matching that in index composition.

-

Thus when you buy Index ETF units, you essentially buy units of mutual fund, and those units correspond to the set of stocks that are part of the index, in proportion matching with index composition.

-

ETF units are exchanged between buyers and sellers

-

Following figure shows some of prominent points including advantages of NIFTYBEES, which is comes high on its performance

-

NIFTYBEES - ETF representing stocks in CNX Nifty Index

Traded on NSE

-

Goldman Sachs Asset Management (India) is Fund Manager

-

Total Assets as of Rs 700 Cr as an approximate figure, as found from public domain as of the current date of writing

-

Benchmarked to CNX Nifty index

-

Thus when you buy a single unit of NIFTYBEES on NSE, you essentially indirectly invest in all NIFTY-50 companies in exact proportion (though fractionally) as these companies are, in CNX Nifty Index.

-

Minimum 1 unit can be purchased

-

Advantages of investing in NIFTYBEES ETF

-

Very liquid

-

Excellent co-relation to Index

-

Possibility of beating index return

-

Easy way to match the Index return

-

Being ETF be bought and sold on exchange (NSE). Units go in Demat A/C

-

Eligible for Rajiv Gandhi Equity Scheme

NIFTYBEES is very liquid. This means you can buy and sell units with ease, without having to negotiate buy or sell price hard. ETFs being less popular in India compared to developed markets, liquidity of NIFTYBEES is not as best as say top ranking Index stocks. However, NIFTYBEES carries liquidity that is far more impressive than any other ETF listed in Indian markets.

NIFTYBEES is matching performance of index in impressive way. Thus if CNX Nifty is giving return of 10% across specific dates of year, say whole year, then NIFTYBEES matches that return, with impressively less divergence.

It is important for Index ETF to match index performance. Higher performance of ETF may seem sweet, but it shows 'tracking error' on the part of ETF, and thus carries the probability that ETF at times may under-perform index.

However, NIFTYBEES has been impressive in its co-relation to CNX Nifty, the underlying it carries

NIFTYBEES can be part of your 'core' equity portfolio or it could be part of your 'satellite' equity portfolio.

NIFTYBEES very well can be major part or only part of your equity portfolio

One can beat index if he or she could optimize profit booking at right points and re-entry points are chosen accurately.

More complex ways will involve hedging NIFTYBEES using Futures and Options in NIFTY contracts. Note that NIFTYBEE being index ETF, using Futures and Options on NIFTY is excellent way to hedge your NIFTYBEE investments.

New equity investors can save tax!!

-

Note that if when there is change in index composition, skills of fund manager comes into play in ensuring that NIFTYBEES still matches the return provided by index, as seen in its new composition. NIFTYBEES gets high rank in this department.

-

While NIFTYBEES is mapping to CNX Nifty, its sibling NIFTYJUNIOR is mapping to CNX Nifty Junior

-

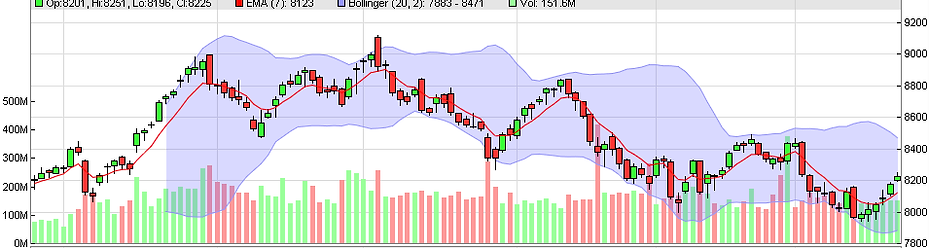

Above graph shows CNX Nifty as on 19-June

-

Below graph shows NIFTYBEES as on 19-June. Co-relation between two graphs is clearly seen.

Summary Lines:

-

Investing in best performing Index ETFs NIFTYBEES and JUNIORBEES is must for all equity investors

Date: 23-Jun-15

-

Voluntary disclosures: We have no holding in discussed stocks/securities above. We have received no consideration for preparing above article. We have no interest and relations with any of management of above discussed stocks/securities.